Read before: Which supplier master data is critical?

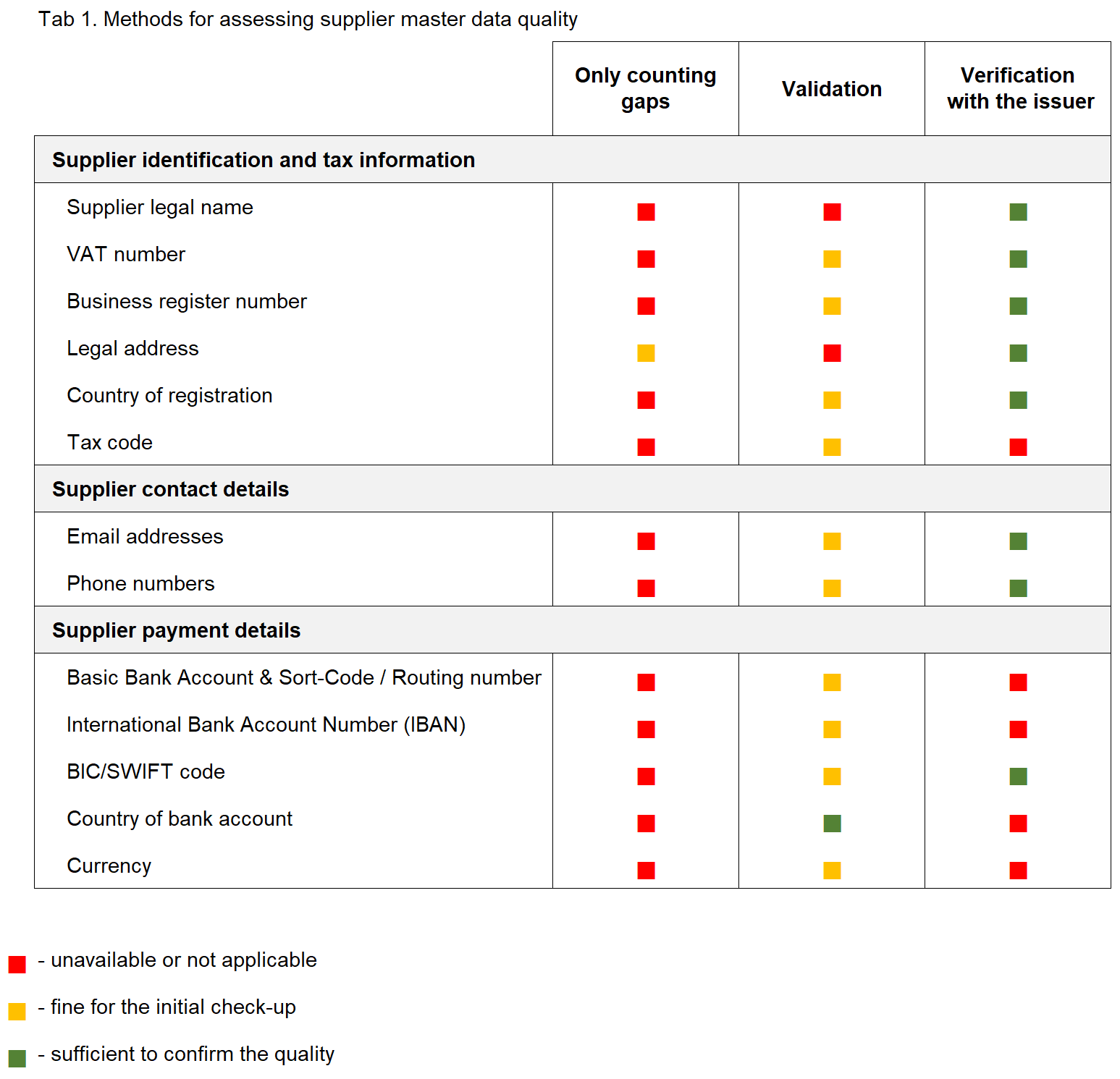

The following three approaches may be applied in order to assess the quality of critical data points in supplier master data:

- counting only the gaps;

- validating existing data to a specified format and standard;

- verifying the ownership and actuality of the existing data with the issuer or official registrar.

The selection of the correct method depends on a specific data point – Table 1.

Supplier legal name – the quality is defined by the percentage of supplier names that match VAT or business registers’ information. Spelling may vary within the registrar’s ‘same as’ rules, for example, Companies House (Section 6.3). Datanovel uses algorithms that completes 75 per cent of matches on average. The remaining 25 per cent requires a manual investigation, and is normally the main focus of the ‘dirty data fixer’ specialists.

VAT Number – the quality is measured as a percentage of verifiable EU VAT numbers at VIES or UK VAT number at GOV.UK. Gaps are not counted because some companies might be not registered for VAT. Datanovel offers an easy-to-use tool in order to verify EU and UK VAT numbers in bulk on Excel – click here to download.

Business register number (company register number, CRN in the UK) is barely available in a typical vendor file. It is wise to add this information during data cleansing for the purpose of robust company identification within data consolidation activities. Quality is measured as a percentage of the existing UK CRNs that pass verification at the Companies House website. For other countries, Datanovel recommends using OpenCorporates (the manual search is free). Gaps should be included because the business/trade register number is compulsory for every country. For some countries, such as China, the USA and Mexico), the tax code can be used for this data element.

Legal address, country of registration – this information is required on any document issued within P2P. Furthermore, it is used to confirm a legal entity when the vendor name does not match the official register. Vendor files often mix operational and legal addresses; therefore, verification similar to the business register number (see above) is required. Gaps should be included when the percentage of quality entries is estimated.

Tax code – UK UTR/NI are considered to be confidential; consequently they cannot be verified in an official register. Therefore, at least the structure should be validated in order to confirm the quality of this data. In some countries, the tax code can still be verified officially; for example, US TIN at IRS’s website.

Email addresses – actuality defines the quality that can be confirmed with a third-party email verifier which guarantees that over 95 per cent of valid email addresses will not bounce.

Phone numbers – as with email addresses, a third-partly phone number verifier can perform carrier lookup to ensure message delivery.

Payment details – existing details in the legacy system can be deemed reliable if a payee has confirmed past payment at least once. Additional validation of this data’s structure and format is still required in order to avoid any non-compliant correction/transformation during migration. This validation helps to measure a percentage for the quality and defines the necessary amount of cleansing. Suppliers without any type of bank account should be included in quality estimation as gaps. Cleansing can be conducted with the segregation of duties (recommended).

The lowest rate from above defines the overall quality of the supplier master data.

Datanovel helps with measuring existing supplier master data quality by verifying it with the issuer (the last column in Table 1). Please enquire us for:

Read next: Is there a real problem with my supplier master data?