Hidden costs of manually verifying VAT numbers in a workflow

Verification of counterparts’ VAT numbers is a common routine for business teams.

Vendor management teams typically follow this step in the process of:

- a new supplier onboarding – VAT commonly used to identify a legal entity;

- reviewing an existing supplier – VAT helps to derive accurate information from official sources in order to reconfirm the legal name and address in the vendor file.

Digital transformation teams verify VAT numbers during data cleansing and migration activities in an attempt to:

- identify the legal entity in every line of the vendor file in the legacy system;

- identify duplicates;

- evaluate overlaps between ledgers or systems;

- enable integration of e-sourcing, e-invoicing or other solutions which often use a VAT number as the main identification for matching legal entities.

Other teams may also validate VAT numbers in their workflows, for example:

- Procurement teams use VAT numbers to evaluate supplier families, consolidate spend, pull supplier information from external systems in order to reconfirm the supplier’s compliance with codes of conduct.

- Payment teams typically use VAT numbers for invoice matching.

- Tax teams might be accountable for the timely actualisation of VAT numbers, thereby ensuring a successful VAT classification and return.

When a business intelligence solution (i.e. Dun & Bradstreet) is integrated into the organisation’s finance system, teams may not even notice how VAT numbers are seamlessly and frequently verified and updated in the system; hence, manual VAT verification steps are unnecessary. However, such integrations are costly and therefore not common as they require the majority of teams to check VAT numbers manually on official websites – VIES for EU VAT numbers and GOV.UK for UK VAT numbers.

Although both websites are simple to use, the user still needs to allocate time for completing the following steps:

- Open the website (or return to the home page).

- Select the member state from a drop-down list (not required on GOV.UK).

- Copy, paste, and submit the VAT number.

- Save the result as a PDF or screen-shot for audit.

With a good internet connection, this routine requires at least 2 minutes per VAT number, excluding the time needed to process the outcome. Neither EU VIES nor GOV.UK offers verification in batch; therefore for multiple checks, each VAT number must be processed individually; consequently, the overall time spent on these websites becomes substantial.

For example, if a company holds 5000 suppliers in a vendor file, and its vendor management team reviews and updates them at least twice a year, additionally 100 new companies monthly. The total time needed to verify VAT numbers on gov websites during a one-year period totals about 50 full working days of one FTE (based on 2 minutes per check). This involves over 2 months of 1 FTE only for verifying VAT numbers for this example. This time could be used on improving supplier compliance, deactivating suppliers who are no longer viable, consolidating spend, and other important activities for the business.

Validating VAT numbers in a batch by sending email

Teams who intensively verify VAT numbers in their workflows (as in the above example) can save a significant amount of their time by using the new tool from Datanovel. This tool allows sending email with the list of VAT numbers (up to 1000 items) and receiving the verification report back into their mailbox. Benefits of using the tool:

- Single place for verifying EU and UK VAT numbers;

- The batch of VAT numbers can be sent in one email.

- Your mailbox automatically stores verification action evidence (includes VIES / GOV.UK stamps) in your mailbox for an audit. No exporting of PDF or saving screenshot is needed when using an official website.

- Evaluated by VAT number, UK companies additionally checked with Companies House to confirm their legal name and status (such as ‘active’, ‘dissolved’, ‘insolvency proceedings’, ‘administration’);

- Once verified using the tool, a company is re-evaluated every 7 days, and the user automatically notified when any information about their suppliers/customers has moved.

The Datanovel VAT Verification tool is designed and continues to develop for efficient reduction of business risks related to wrong or outdated supplier data such as incorrect VAT return and classification, incorrect purchase order creation, incorrect/incomplete spend consolidation, incorrect invoice matching, and overdue payments.

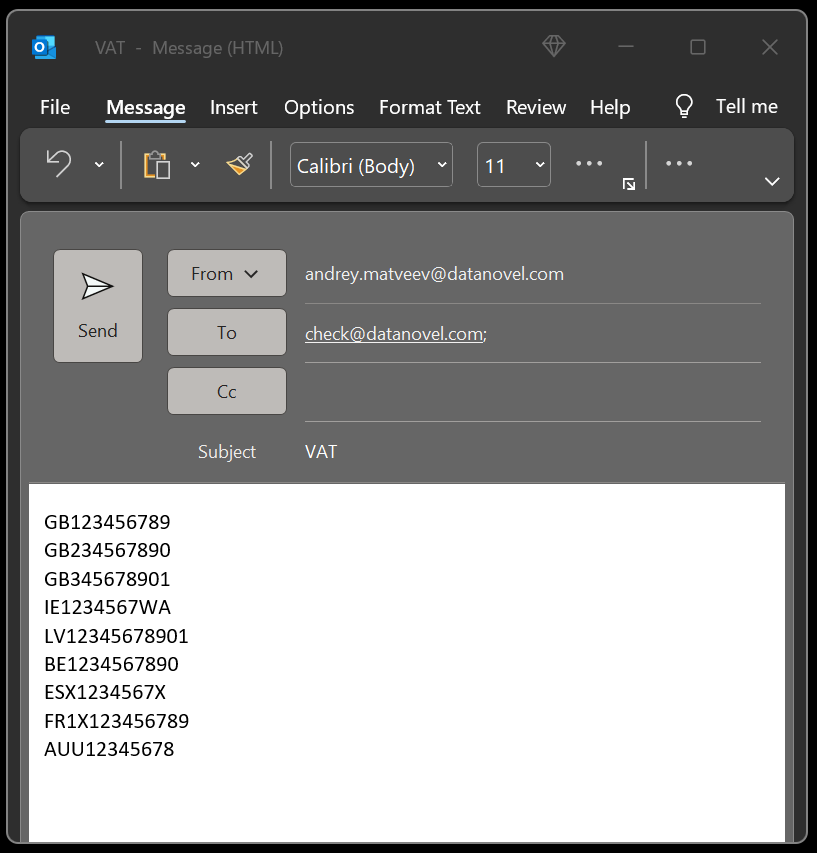

How to verify VAT number via email

Copy-paste the list of VAT numbers (or just one) on a new email and send it to check@datanovel.com with the subject ‘VAT’. Each VAT number should be prefixed with a two-character country code (i.e., GB, IE, FR, DE). Up to 1000 VAT numbers can be submitted simultaneously. Any information included in an email and not recognised as a correct format VAT number will be ignored.

The reply will be received in few minutes, depending on the number of submitted VAT numbers (processing of 1000 takes about 2 hours). During this time the tool will consult with VIES, GOV.UK and Companies House to pull the accurate information. In response, you will receive the following results of verification:

- VAT number status (Valid / True or Nonvalid);

- Company name as in the VAT register / group of companies sharing the same VAT number;

- Time stamp and consultation number from an official source (VIES or GOV.UK).

- The original email, enabling the user to evaluate information (e.g. VAT numbers in incorrect format) which is not recognised and verified.

Additionally for UK companies:

- Company name as registered in Companies House;

- Legal status of the company (such as ‘active’, ‘dissolved’, ‘insolvency proceedings’, ‘administration’);

- Previous name, if any and number of days since the name change.

Try this new tool by sending your VAT number to check@datanovel.com with subject VAT